Baseload Generation: Market Failures, Inefficiencies

The mix of fuels making up the U.S. power sector is constantly evolving, responding to market forces including the changing price of fuels, the mix of new generator construction, government policies such as renewable portfolio standards, and technological improvements. As the share of U.S. electricity that is being generated from renewable energy and natural gas continues to grow, increasing focus is being placed on ensuring adequate and reliable baseload generation at a time when traditional baseload energy sources are being replaced with non-dispatchable, or intermittent, power generation.

What is Baseload Generation?

Generation from a baseload plant is defined by the Energy Information Administration (EIA) as a plant that “is normally operated to take all or part of the minimum load of a system (i.e., the “base” load), and which consequently produces electricity at an essentially constant rate and runs continuously.” Baseload power plants do not change production to match power consumption demands. Historically nuclear power, coal-fired plants and natural gas combined cycle plants filled this need for system operators. In this context, baseload power is essentially referring to the reliable and dispatchable energy sources that are typically operated on an around the clock basis.

Baseload generation specifically excludes power from intermittent sources of energy such as solar and wind because electricity cannot be reliably generated from them when the sun isn’t shining or the wind isn’t blowing. Because natural gas is also used for heating needs, extreme cold conditions can sometimes prompt an increase in natural gas use by regional gas utilities that can result in little to no gas pipeline capacity available for use by electric generators, reducing their ability to provide baseload generation in these circumstances.

Current Generation Structure

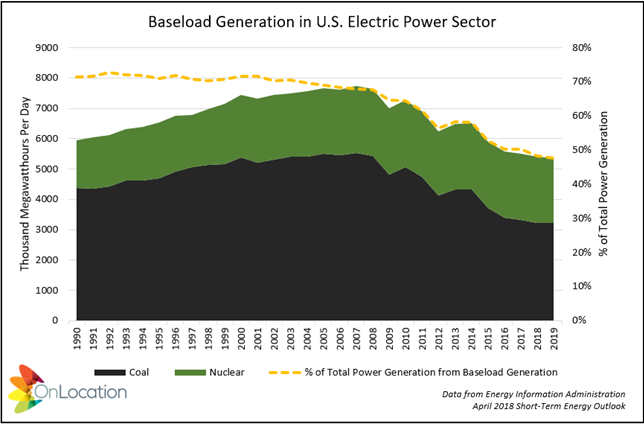

The recent debate surrounding baseload generation compared with non-dispatchable energy resources has become increasingly prevalent due to market forces flipping the script from decades past. Historically, coal was the cheapest fuel and thus made up a majority of the electric power generation in the United States. After the initial capital costs of building a power plant, nuclear power was always among the cheapest energy sources as well. However in recent years, natural gas prices have plunged to all-time lows and renewable energy costs are constantly dropping, setting up situations where the baseload generators are no longer the cheapest sources of energy, with coal-fired and nuclear plant retirements increasing with no new baseload plants replacing them. Combine those market forces with debates surrounding the environmental impacts of nuclear power and the climate concerns related to coal, and the new normal is that the non-baseload fuels are accounting for an increased portion of the U.S. energy mix. Coal and nuclear still accounted for a combined 50% of total U.S. electricity generation in 2017, but that’s trending down from 68% just a decade earlier, with that trend forecast to continue and drop baseload power to 48% of the total mix by 2019.

For all the evident benefits of an energy mix increasingly relying on clean energy sources like renewables and more affordable fuels like natural gas, several concerns have arisen connected to these changes.

Questions and Issues around Baseload Generation

The first question is whether the electrical grid will have enough dispatchable energy resources to cover the energy needs when emergencies cut off parts of the natural gas pipeline system or when the weather is unreliable and cannot ensure sufficient natural gas, solar power, and wind energy to meet the grid’s needs:

- When baseload generation was the cheapest source of energy, the ISO markets operated to ensure the reliable operation of the grid and these generators were adequately compensated, but now that cheap natural gas and renewable generation are often more competitive, market forces alone are not necessarily enough.

- Further muddling the waters are the competing claims as to whether the closing of nuclear plants threatens overall grid reliability.

Another issue relating to baseload generation in this new U.S. energy mix is the inefficiencies in the market that are being created:

- For example, when solar generators are working at peak capacity during the middle of the day, baseload generation plants must continue to maintain a minimum level of operation, resulting in situations where there is an overabundance of energy on the electric grid that cannot be used by its customers and cannot yet affordably or efficiently be stored for later use.

- Not only is this scenario inefficient in terms of wasted energy, but much of this power generated during the day ends up priced at zero or even negative prices, so baseload generators must sell their power at a loss during those hours.

Government Debates and Grid Resilience

The question of how to treat baseload power in a grid filled increasingly with non-dispatchable energy sources has been at the center of recent government debates. Last Fall, the Department of Energy (DOE) released a study of the U.S. grid that found that cheap natural gas and growing renewable resources are among the reasons that baseload plants are being retired at an increasing rate, recommending that the Federal Energy Regulatory Commission (FERC) study ways to ensure long-term reliability and resilience of the grid and baseload generation. DOE followed that study up with a proposed rule that would financially compensate power generators who could keep 90 days of fuel onsite, providing a leg up to baseload generators of coal and nuclear and hindering the market competitiveness of natural gas and renewables. While that proposal was rejected by FERC on a legal basis, DOE is still looking to find a mechanism to help bolster the outlook of coal and nuclear generators and ensure the survival of the baseload generators. Meanwhile states are trying to fill the void, including:

- New Jersey’s vote to approve a subsidy to preserve the long-term survival of their nuclear plants;

- Illinois and New York passing legislation that provides nuclear plants with ratepayer subsidies for their clean energy generation;

- Connecticut’s efforts to allow nuclear energy to receive financial credits for producing carbon-neutral energy the same way that renewable energy sources do; and

- Other pro-nuclear laws in Connecticut, Ohio, Minnesota, and more.

Conclusion

How the debate about market failures and inefficiencies impacting baseload generation in an increasingly non-dispatchable energy mix, and the government’s role in mitigating those impacts, will be resolved is anyone’s guess. But in a time of fast-moving technological innovation and quickly-changing market forces, staying aware of the situation and how it evolves is critical to every stakeholder in the electric markets.

Contact us to learn about how OnLocation can help you explore issues related to energy and the electric grid system.