Examining a “No Regrets” Policy to Facilitate a Transition to a Lower Carbon Future

Case Study

Get a copy of Examining a “No Regrets” Policy to Facilitate a Transition to a Lower Carbon Future

"*" indicates required fields

Objective

Carbon Capture and Storage (CCS) continues to become a more viable option for reducing carbon emissions in the atmosphere. The team at OnLocation used the National Energy Modeling System (NEMS) to examine the potential for CCS at power plants to be used in Enhanced Oil Recovery (EOR). The study dives into the quantity of CO2 that could be sequestered, the impacts a tax credit policy would have on CCS and EOR, the effects of lower natural gas and shale resources on CCS adoption and EOR production, as well as cost reduction for CCS and the effects on EOR. Analyzing these factors gives insight into the viability and potential outcomes of EOR using CCS from power plants within multiple scenarios.

NEMS

The National Energy Modeling System was developed by the EIA and is used by the federal government and private businesses to assess and project energy events. NEMS is used to produce the Annual Energy Outlook and can be found in research from the DOE and multiple non-governmental organizations. The system is used extensively at OnLocation with the company working directly with the EIA to enhance the model. Using NEMS allows for a plethora of variables to be manipulated within its modular structure to optimize techniques used for electricity capacity expansion, dispatch, and petroleum refining. In this study, NEMS was used to project the effects of different scenarios surrounding CCS and EOR.

Methodology of CTUS

The Modules of interest within NEMS for CTUS are the Oil and Gas Supply Module (OGSM), Electricity Market Module (EMM), Liquid Fuels Market Module (LFMM), and CTUS. Each of these modules are used in conjunction to produce a model of the consequences of CCS in EOR.

Scenarios & Outcomes

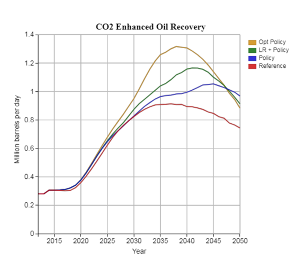

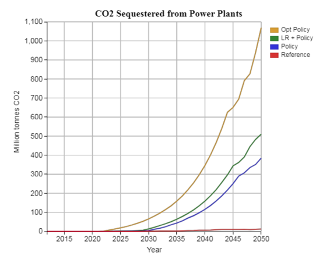

There were multiple scenarios examined within the study which changed the market and legislative variables. The Reference Case (Reference) was conducted using the 2017 Annual Energy Outlook reference case and included high economic growth and electricity demand, along with favorable EOR cost assumptions. The Tax Credit Policy (Policy) implemented a tax credit for CO2 captured and used in EOR as well as a tax credit for CO2 sequestered in geologic storage. The Low Oil and Gas Resources (LR + Policy) uses the same legislation from Policy with lower oil and gas shale resources. The Combined Optimistic Low Cost and Policy (Opt Policy) also includes a reduced cost of coal CCS with a margin 20% lower than Reference.

The implementation of the scenarios within NEMS produced projections that demonstrate the increase of CO2 sequestration and CO2 EOR when market and legislative forces make the process more economically viable. In both figures, the external pressures of tax credits and lower gas reserves spur growth in the sequestration of CO2 from power plants and expand the use of CO2 EOR.

Conclusion

The viability of CCS for EOR is heavily dependent on externalities that are the result of changes in market and policy conditions. Under the right market and policy conditions, significant amounts of CO2 would be able to be sequestered. The sequestration of CO2 changes over time as the initial form of CCS is EOR, while long-term sequestration is performed with high volumes of CO2 in saline formations. The scenarios put forth identify that both a sequestration tax credit, higher prices on natural gas, and lower CCS costs all stimulate CCS investment and adoption over time.

OnLocation was able to identify and quantify the scenarios which would have to occur to stimulate CCS investment using NEMS; determining that exterior forces in the market and policy would have to occur to increase the sequestration of CO2 from power plants.