Batteries: An Essential Technology for the Energy Transition

Role of batteries for clean energy transition

Vehicle and utility-scale batteries are central to achieving a sustainable energy future, and especially resolving the challenge of integrating variable wind and solar electricity into power grids. Batteries can store excess energy during periods of high generation and discharge it when generation levels drop. This effectively mitigates the intermittency issues associated with some renewables, ensuring a more consistent and reliable power supply. Battery-powered electric vehicles (EVs) offer a solution to the vexing problem of decarbonizing ground transportation. Widespread adoption of EVs would directly reduce greenhouse gas emissions by displacing fossil fuels and can potentially serve as grid-scale energy storage through vehicle-to-grid (V2G) technologies. Nevertheless, there are concerns about supplies of the critical materials required for these batteries given the anticipated ramp up in their sales. A recent OnLocation whitepaper focuses on lithium (Li), nickel (Ni), cobalt (Co), and manganese (Mn), which are prevalent in electric vehicles. We also provide qualitative assessments of environmental, supply chain, and energy security issues related to critical materials for the U.S. The whitepaper can be found here.

EV battery markets

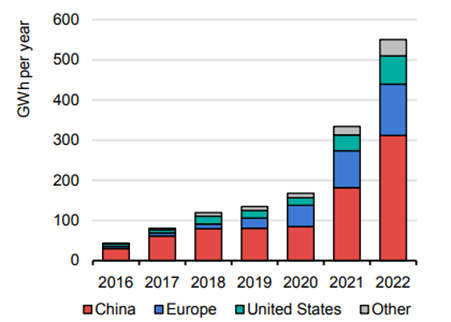

In 2022, global demand for automotive battery capacity increased by 67% (to 550 GWh) compared to 2021 (330 GWh), primarily due to growth in light-duty vehicle (LDV) sales. In the U.S. and China, battery demand for vehicles grew by approximately 80% and 70%, respectively, in 2022 relative to 2021 (Figure 1). Government policy and subsidies have been a major driver of EV deployment and are expected to be critical in accelerating global EV growth over the coming decades. In 2022, more than 90% of global electric LDV sales were in countries with policies (e.g., fuel economy and pollutant standards, zero-emission vehicle mandates, and purchase incentives and subsidies) that encouraged EV sales.

Figure 1. EV battery demand by region for 2016-2022 (Source: Global EV Outlook 2023)

Policies announced in 2022-2023 by the European Union (new CO2 standards) and the U.S. (the Inflation Reduction Act or IRA) will likely have major impacts on the zero-emission vehicle market. The IRA, along with the adoption of California’s Advanced Clean Cars II rule, is expected to increase the market share for electric cars to 50% in 2030, consistent with the Biden Administration target. Implementation of U.S. Environmental Protection Administration’s (EPA) recently finalized vehicle emissions standards could further accelerate EV adoption (see OnLocation’s white paper on policy-driven EV demand analysis).

Utility-scale energy storage battery markets

In 2022, global utility-scale battery storage capacity grew by 23%, a 16.6 GW increase in global capacity to about 90 GW. In the United States, 4.8 GW of capacity was added in 2022, bringing total installed capacity to 8.8 GW .

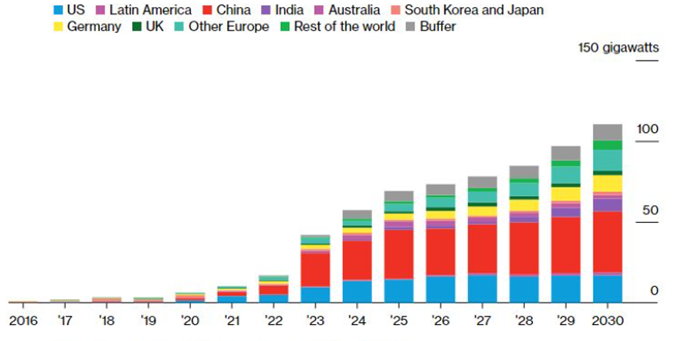

According to Bloomberg New Energy Finance (BNEF), global energy storage will continue to grow, with estimated annual additions averaging 110 GW of output capacity with 372 GWh of energy capacity annually through 2030. Per BNEF, China (the world’s largest market), India, Australia, South Korea, and Japan will represent around half of the additions in 2030 on a GW basis; Europe, the Middle East, and Africa will collectively represent 24%; and the U.S. another 17%.

Figure 2. Global energy storage capacity additions by market (Source: BNEF)

Battery chemistries

The impact of batteries on the clean energy transition is closely linked to advances in battery technology and performance, including higher energy densities, faster charging rates, and longer cycle lifespans. The current EV and energy storage battery market is dominated by lithium-ion (Li-ion) batteries. The most commonly used chemistries for cathodes include nickel manganese cobalt oxides (NMC), lithium iron phosphate (LFP), and nickel cobalt aluminum oxides (NCA), with graphite as the primary choice for anodes.

Specific energy, in the context of batteries, refers to the amount of energy stored per unit mass or volume. This metric is crucial in determining the suitability of a battery for a particular application. For EVs, batteries need to be energy-dense to maximize range while remaining compact and lightweight. In contrast, stationary grid-scale energy storage systems prioritize factors like cost-effectiveness, durability, and storage duration over size and weight.

NMC is the prevalent battery chemistry for EVs with a market share of 60% in 2022 due to its high specific energy, while the LFP battery is currently the primary chemistry for stationary storage due to its lower cost, safety performance, and long cycle life. There is increased interest in LFP implementation in EV batteries (which recently achieved the highest share of the EV market ever) mainly by Chinese automakers because, in addition to being cheaper, they do not require critical materials such as nickel or cobalt that may have significant price volatility.

While NMC and LFP batteries are expected to remain the most prevalent batteries in this decade, the future battery market share is highly uncertain. Li-ion battery technology improvements and the advancement of emerging high-performance battery technologies such as lithium anode all-solid-state batteries with boosted energy density and reduced dependency on critical materials may influence the market. For instance, for stationary storage, long-life flow batteries could emerge as a breakthrough technology. Sodium-ion batteries are another alternative to Li-ion chemistries because they rely on lower cost and widely available materials while entirely eliminating the need for critical minerals.

Battery costs and critical materials issue

The global average cost of Li-ion batteries has dropped by almost 90% over the past decade, falling to 139 $/kWh in 2023, mainly due to the remarkable growth in EV sales. The price of batteries varies across the world. According to BNEF, China has the lowest prices at 126 $/kWh on average, while packs in the U.S. and Europe were 11% and 20% higher, respectively. The lower cost of batteries in China can be attributed to economies of scale; China accounts for about 65% of global battery cells and nearly 80% of cathodes. BNEF estimates that technological innovation, manufacturing improvements, and continued capacity expansions may drive further cost reductions worldwide, to 113 $/kWh in 2025 and 80 $/kWh in 2030.

With major technological improvements in battery cell production and pack design achieved over the past decade, raw materials now account for the majority of total battery costs (up to 70%). While falling prices have been driven by scale learnings and technological innovation, battery prices are now closely following raw material prices. Given the importance of materials in total battery costs, further cost reduction will be largely dependent on future trends in material prices and the ability of manufacturers to substitute lower for higher cost inputs.

As the demand for and importance of batteries increases, maintaining a dependable, secure, and low cost supply is a growing challenge. Reduced use of critical materials may be essential for an assured supply of economical batteries, considering that the sources of critical minerals are limited and at least potentially at risk of interruption. For example, China dominates the processing of lithium, nickel, and cobalt. Recognizing the importance of critical materials for the U.S. energy transition, OnLocation has developed a novel application of the National Energy Modeling System (CM-NEMS) and conducted an initial projection of critical materials demand for U.S. electric vehicles (EVs) to 2050. Read more about OnLocation’s critical materials work by accessing our white paper here.